When it comes to exploring and applying new models and techniques, our profession is much too circumspect. But we are missing opportunities, as Artificial Intelligence is nothing without Actuarial Intelligence.

What is AI?

Asking a number of people to define artificial intelligence will result in almost as many different definitions. For the purposes of this article, we will define AI as being a system that is capable of assessing new situations based on examples. Such systems are able to function thanks to algorithms, which are trained using machine-learning techniques (including deep learning).

History

Many people consider artificial intelligence to be ‘something new’. However, it was more than 60 years ago that the famous Dartmouth Summer Research Project on Artificial Intelligence was organized by the then 28-year-old mathematician John McCarthy. Two years later, McCarthy developed Lisp, a functional programming language that would become popular for developing AI systems and is still in use today. At the end of the 1970s, the world champion backgammon player, Luigi Villa, was beaten by a computer. In the 1980s, statistic models that had already been around for much longer were extended to include machine-learning methods. By the 1990s, you could purchase a chess computer capable of playing at master level for just a couple of bucks.

A departure from the trend

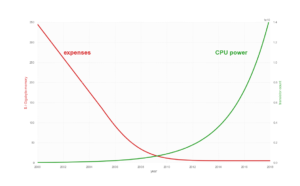

So, clearly, the technologies underpinning AI systems have been around for several decades. The departure from the trend came when, due to the growing availability of data and computing power (figure 1), using such techniques for practical applications became possible, catapulting AI from the laboratory to the supermarket and from the study to the living room. In the 1990s, getting a neural network to work was quite a challenge. Now, all it takes to train and validate a network of this kind is a couple of lines of code. Thanks to the proliferation of autoML platforms, the time required for actually getting such models into production has been considerably reduced.

Developments in insurance

Over the coming years, parties that have fully digitalized their processes will be bringing insurance products onto the market at an accelerated rate. Such parties are capable of using chatbots for optimizing the customer experience effectively, while still maintaining the human dimension. Companies such as Lemonade in the United States and Nexible in Europe have for some years been setting the tone in this respect. In addition, technology players such as Google and Amazon will be using their global distribution networks to offer insurance products that cover the ‘new’ risks brought by digitalization and data management. As they are in constant contact with potential end customers, these companies are perfectly positioned to offer them pay-as-you-go products and services at just the right time. The providers of transport concepts, such as the self-driving car, will be prepared to insure certain risks ‘for free’ – in exchange for data. During the Digital Insurance Forum 2018, it became clear that tomorrow’s winners will be those that are prepared to invest heavily in new technology, based on a comprehensive customer strategy. Such organizations are making clear decisions and keeping a watchful eye on the progress of their digital transition using readily intelligible KPIs. In this changing environment, insurers will go with the flow by working more closely with new partners (insurtechs), as part of a larger ecosystem, and will start to play new roles within it as the coordinators and suppliers of ‘active’ insurance products.

Strategy

Just like other technologies, AI is not an aim in itself. Just because something is interesting and innovative, that does not automatically make it useful. However, it does become useful if it contributes to an organization achieving its strategic objectives. Insurers who want to get closer to their end customers, for example, can decide to use AI to render their claims process ‘frictionless’, all the way from claim handling to damage prevention. If such a transition is to be successful, insurers should not start by looking at the technology itself but instead by examining the customer experience – by mapping out the customer journey, for instance.

What the actuary can contribute

Through working with some data scientists recently, I have become convinced that, as a profession, we can make a fundamental contribution to the developments involving AI. We are thoroughly grounded in linear algebra and statistics, which provides us with a firm foundation for comprehending machine-learning models – the brain behind every AI system. This foundation enables us not only to interpret the results generated by models but also to translate them back into the original business problem. We know that each model is based on a large number of assumptions, even though this is often not expressly stated, and are able to point towards the impact this has. Ultimately, AI is not about building complex models but has instead to do with using data to solve problems. We are capable of showing what any particular solution will mean in terms of the client’s operating result.

Ethics

AI can help people to make better choices, whether that choice relates to an insurance policy, a film or a new partner. This is fantastic. But, just like any other technology, AI is also used for purposes that can be harmful to humanity. People are already saying that AI will lead to a large, useless underclass – the ‘have-nots’ – or even to digital dictatorship. As a profession, we not only have the responsibility to think about this but also to make our own position known, if necessary.

Teamwork

If you get a few people together and ask them to talk about AI, you will notice that there is no lack of hype and buzz. Within a team, an actuary, adopting a constructively critical stance, can act as a counterweight to this. At the same time, actuaries will realize that they can learn a lot from their fellow team members and data scientists. Thinking in terms of data, for example. Hacking skills, new tools, open source, and knowledge sharing. And an ‘anything-is-possible’ mindset. By staying true to their roots while at the same time being receptive to new concepts, they can act as a valuable bridge between domain, content and client within the team.

Conclusion

AI ceased being something that belonged to the future some time ago now. This is technology that is already influencing the choices millions of people make on a daily basis. By adopting a constructively critical stance that is driven by curiosity, actuaries working in multidisciplinary teams can make a substantial contribution to this interesting development. In other words, they can use their Actuarial Intelligence.

Acknowledgements: I would like to express my gratitude to the following individuals for their useful comments on this post: Nart Wielaard, Hylke Niermeijer and the members of the Actuarial workgroup use cases.